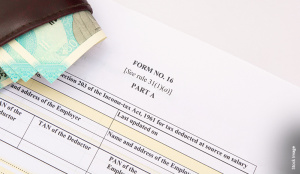

TDS PAYMENT ADVICE FILLINGS & FORM-16 & 16A ISSUANCE

The process of TDS (Tax Deducted at Source) payment advice filings and the issuance of Form 16 and Form 16A involves the deduction of taxes at the source, the submission of payment advice, and providing certificates to deductees.

- Deduct TDS:

- Deduct TDS as per the applicable rates while making payments, such as salaries, interest, rent, commission, etc.

- Generate TDS Payment Advice:

- Prepare a payment advice specifying the details of TDS deducted, including deductee details, PAN, amount, nature of payment, and tax deducted.

- Use Appropriate Challan:

- Pay the TDS amount using the relevant challan designated for TDS payments. Challans commonly used for TDS payments are ITNS 281 for non-salary TDS and ITNS 281 for salary TDS.

- File TDS Return:

- After making the payment, file the TDS return using Form 24Q (for salary) or Form 26Q (for non-salary)